Throughout 2012, BNBR Was Successful In Reducing Debt

Source: Humas BNBR | 03 Dec 2012

Next year, PT Bakrie & Brothers Tbk (“the Company” or “BNBR”) will focus more on efforts and efforts to pay off or reduce debt burden.

The company will continue to implement a strategy of refinancing short-term debt, high-cost and has a large guarantee as the main focus. Debt repayment will also be done, among others, through the sale of some assets and investment returns. As of the end of September 2012, the Company had succeeded in reducing the consolidated debt burden by 34.5%, or equivalent to Rp.3.7 trillion.

“Since the beginning of 2012, we have actually maximized our efforts to reduce debt burden, because we are aware that large debts will have bad implications for the Company’s performance,” explained Bobby Gafur Umar, Director / CEO of BNBR to reporters, after the Public Expose event at Jakarta, Monday (3/12).

Throughout 2010 and 2011, BNBR’s debt has swelled due to the Vallar Plc or Bumi Plc transactions, reaching Rp.9,559 trillion. But until September 2012, we have managed to reduce the amount of debt very significantly. We managed to carry out debt management carefully, “said Bobby Gafur Umar.

Closing the year 2012, Bobby is very optimistic that the Company will record positive financial performance. “We have successfully booked a net profit in 2011 after three consecutive years of loss. The main contributors to the Company’s future revenue will come from the infrastructure and manufacturing businesses, “Bobby said.

During the first nine months PT Bakrie & Brothers Tbk managed to book a net profit of Rp253 billion, up 138.8 percent from the same period in 2011.

Non-public Subsidiaries

The management of PT Bakrie & Brothers Tbk (“BNBR” or “Company”), according to Bobby, is determined to continue to strengthen and sharpen the Company’s business fundamentals. A number of strategic initiatives have been launched. Measures to maintain organic and inorganic growth have been developed, and efforts to strengthen the capital structure have also been prepared.

According to the Managing Director / CEO of BNBR, Bobby Gafur Umar, the growth momentum of non-public subsidiaries, which has increased significantly this year, will continue to be maintained, as one surefire strategy to sharpen the company’s overall business fundamentals.

“We want to continue to maintain the company’s organic growth, through investment in development projects based on natural resources and infrastructure; and increasing the value of non-public assets. In principle, BNBR’s growth strategy will focus on the energy, infrastructure and plantation sectors, “Bobby told reporters after the Public Expose in Jakarta, Monday (3/12).

He explained, the performance of a number of non-public subsidiaries of the Company this year grew very well. In the manufacturing sector alone, a number of non-public subsidiaries throughout January-September 2012 managed to record revenues of Rp. 2.5 trillion. This number increased very significantly when compared to the non-public subsidiary income in the manufacturing sector in the same period in 2011 which only reached Rp. 1.6 trillion. “Increased by Rp.900 billion. Very significant, “Bobby said.

This growth has made BNBR management very optimistic about the prospects of the Company’s non-public subsidiary. From the Company’s records, several non-public business units in the manufacturing sector such as PT Bakrie Building Industries (BBI), PT Bakrie Pipe Industries (BPI), PT Bakrie Tosanjaya clearly show encouraging business performance, while reflecting very bright prospects.

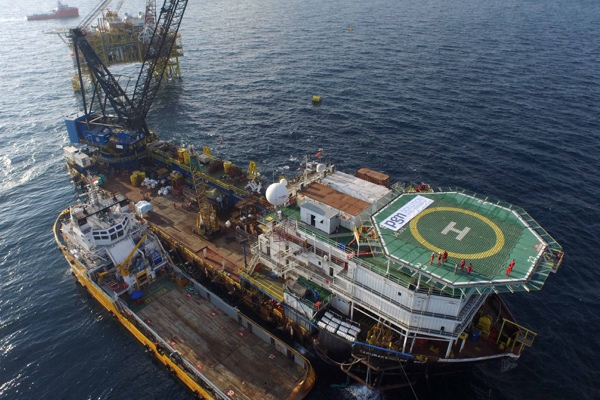

“BBI has very promising growth potential. Likewise BPI has a huge opportunity to penetrate deeper into the non-oil and gas market with the explosion of the infrastructure sector. PT Bakrie Tosanjaya is also very likely to take advantage of the potential growth of motor vehicles in Indonesia, “Bobby said.

PT Bakrie Energy International is an important contributor to the Company’s revenue. Therefore, according to Bobby, his party will encourage the company to be able to continue business with greater added value, such as logistics and supporting facilities for the coal industry in Kalimantan and surrounding areas.

“It also encourages this company to enter the trade in oleochemical products with the potential obtained from PT Bakrie Sumatera Plantations Tbk’s oleochemical production in North Sumatra,” Bobby said.

For Further Information

Investor Relations : Indra Ginting

[email protected]

Head of Public Relations

Bayu Nimpuno

[email protected]